Main Points

- Medicare Part D may cover Ozempic for Type 2 diabetes but not for weight loss.

- Coverage depends on the plan’s list of approved drugs and proper use per FDA guidelines.

- Medicare does not allow coverage for weight control-only prescriptions.

- Cost-saving options include savings cards, patient assistance programs, or price comparisons.

- Ozempic (semaglutide) lowers blood sugar and heart risks for people with Type 2 diabetes.

Introduction

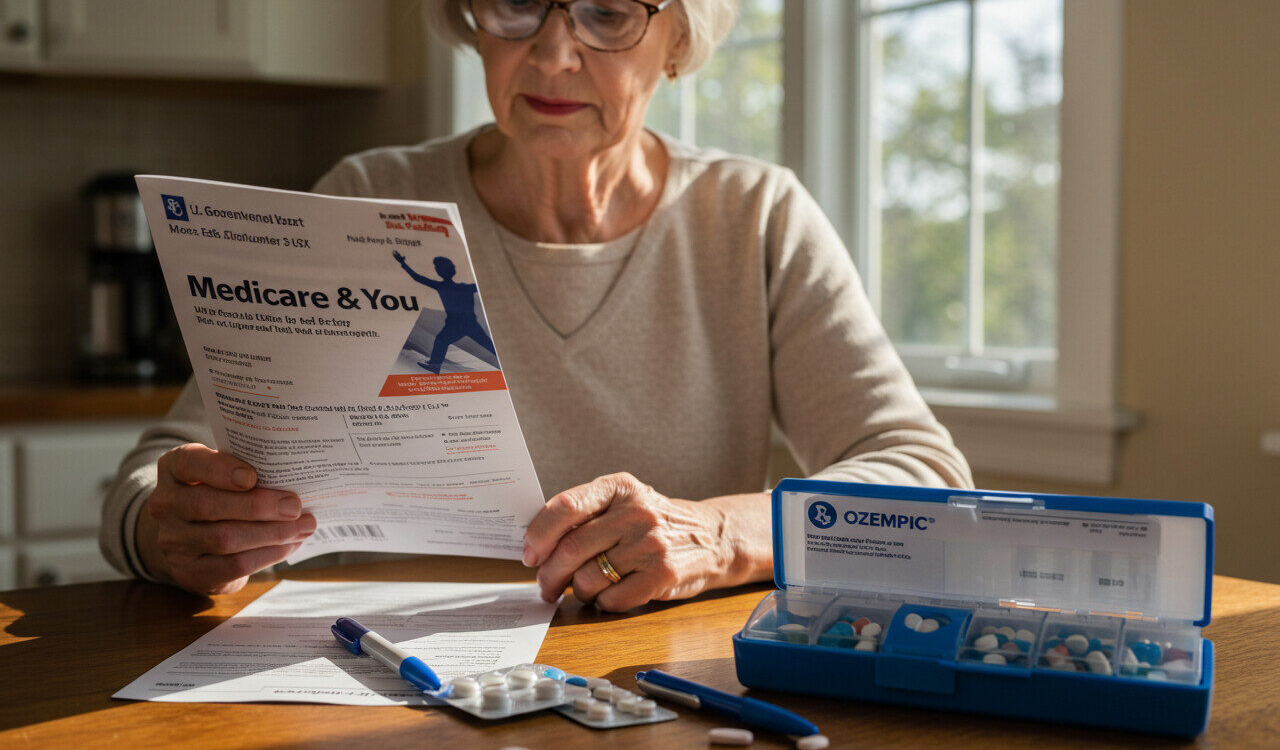

Ozempic helps manage Type 2 diabetes and lowers the risk of heart issues. Many people now use it for weight loss too. This section explains when Medicare pays for Ozempic and how to manage its cost while protecting both health and finances.

What is Ozempic?

Ozempic is a prescription injection containing semaglutide, a GLP-1 receptor agonist. It is FDA-approved for Type 2 diabetes and reducing major heart risks in certain patients. It boosts insulin production, lowers liver sugar output, and slows digestion to help control blood sugar. Although some people lose weight, using it solely for weight loss is not covered by Medicare.

How Ozempic Works For Diabetes

Semaglutide mimics a natural hormone, increasing insulin and decreasing glucagon. It helps maintain stable blood sugar and slows stomach emptying, which can promote a feeling of fullness. Medicare covers it only for diabetes and heart risk per FDA approval.

Who Uses Ozempic?

Older adults with Type 2 diabetes, especially those with heart disease or chronic kidney conditions, commonly use Ozempic. A doctor’s approval is necessary to include Ozempic in a long-term diabetes care plan.

Medicare and Prescription Drug Coverage

Medicare covers hospital visits, outpatient care, and prescription drugs. Medications like Ozempic are included under Part D or Medicare Advantage plans with drug coverage. Always confirm your plan’s drug list to avoid unexpected expenses.

| Medicare Part | Coverage Details |

|---|---|

| Part A | Inpatient hospital care and skilled nursing facilities. |

| Part B | Outpatient care, doctor visits, and medical equipment. |

| Part C | Medicare Advantage combines Parts A and B, often with Part D. |

| Part D | Outpatient prescription drug coverage, including diabetes medication. |

Parts A and B handle general health services, while Part D specifically covers medicines like Ozempic for diabetes treatment.

How Part D Covers Ozempic

Private insurers offer Part D plans, which usually cover Ozempic for Type 2 diabetes with a valid prescription. Not every plan includes Ozempic, and prior approval might be required. Brand-name drugs often cost more due to higher tiers, so check your plan’s list to manage costs.

Medicare Coverage For Ozempic

Yes, Medicare Part D covers Ozempic for diabetes and heart risk reduction as approved by the FDA. It does not pay for weight loss use. Coverage requires the drug to be on your plan’s list and may need prior authorization.

Coverage Conditions

To qualify for coverage:

- You must follow FDA approval for diabetes or heart risk.

- The drug must appear on the plan’s formulary.

- Prior approval may be required to confirm medical necessity.

If used solely for weight loss, Medicare will not pay, and the user bears the full cost.

Diabetes Versus Weight Loss

Medicare Part D does not cover weight loss medications. Ozempic is only covered for approved uses. Weight loss may occur as a side effect but is not a covered reason. For weight management, alternative insurance or personal payment is necessary.

Steps To Access Ozempic With Medicare

Step 1: Confirm diagnosis and obtain a prescription for diabetes care.

Step 2: Check your Part D or Advantage plan for Ozempic coverage. Switch plans during open enrollment if needed.

Step 3: Submit prior authorization if your plan requires it.

Step 4: Use savings options like manufacturer cards, patient assistance, or lower-cost pharmacies.

Final Thoughts

Ozempic is covered by Medicare Part D when used for Type 2 diabetes and related heart risks, not for weight loss. Always check your plan’s drug list, get necessary approvals, and use available savings tools to reduce expenses. Reviewing coverage details and planning ahead ensures access to essential treatment without surprise costs.

FAQs

Does medicare part d pay for ozempic for weight loss?

No, medicare does not cover ozempic for weight loss.

Do all part d plans include ozempic?

No, coverage varies. Check the plan’s drug list and requirements.

Is prior authorization required for ozempic?

Many plans need prior approval to confirm it is medically necessary.

Can I get financial help for ozempic?

Yes, savings cards and patient assistance programs can lower costs.

What happens if my plan does not cover ozempic?

You may switch plans during open enrollment or pay out-of-pocket.

Updated by Albert Fang

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.